2024 is in full swing, and the start of a new year is a good reminder to take stock of our lives and plan for the future. Effective estate planning is a crucial aspect and its importance cannot be overstated. A well-thought-out estate plan ensures that your assets are distributed according to your wishes, minimizes tax liabilities, and provides for your loved ones while building your legacy. This estate planning checklist covers five priorities for 2024 that should be on your radar.

Work with your estate planning attorney to review and update your will and trusts

One of the fundamental elements of estate planning is having a valid and up-to-date will. Life is dynamic, and circumstances change, so it's crucial to review your will regularly, especially after significant life events such as marriages, births, or deaths in the family. Engage your trusted estate planning attorney to revisit and update any trusts you may have established. This ensures that your assets are distributed as you intend and that your loved ones are provided for according to your current wishes.

Don’t overlook digital estate planning

In this digital age, our lives are increasingly intertwined with online platforms and digital assets. Make 2024 the year you address your digital estate planning. It’s smart to create a comprehensive list of your digital accounts, including usernames and passwords, and store this information securely offline. If you have photos, documents, and other valuable information stored online, consider tapping a trusted individual to act as your “digital executor” to share your digital assets with your beneficiaries.

Long-term care planning

As life expectancy increases, planning for long-term care becomes more critical. Evaluate your options for long-term care insurance and make decisions regarding potential care facilities. If you already have long-term care insurance, review your policy to ensure it aligns with your current needs and circumstances. Planning for long-term care can protect your assets and provide financial security for you and your family in the event of extended healthcare needs.

Estate plan tax strategies

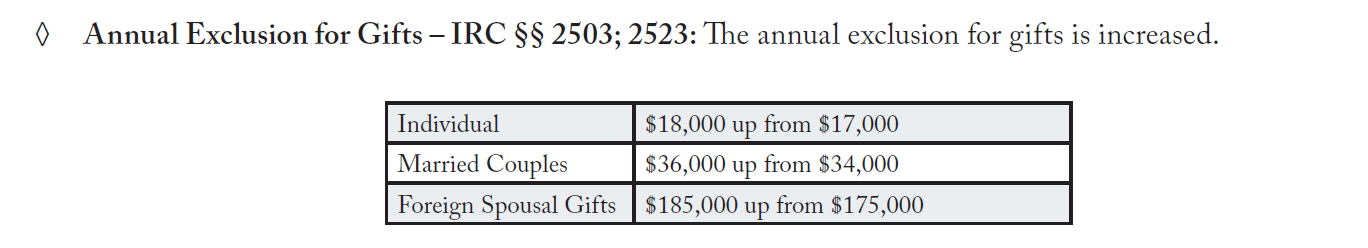

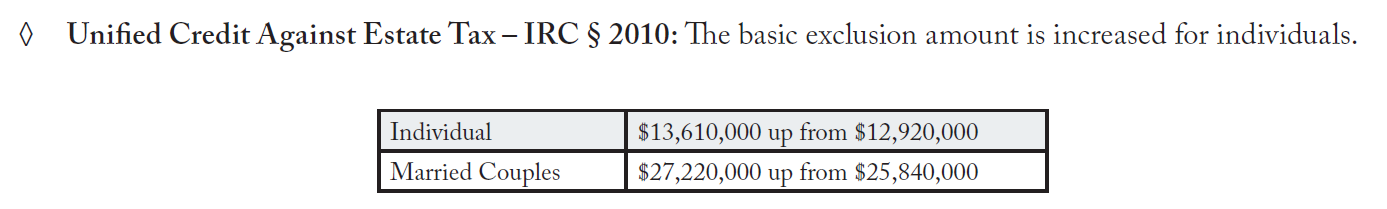

Estate taxes can significantly impact the distribution of your assets. In 2024, consider working with a financial advisor or tax professional to explore tax planning strategies that can minimize the tax burden on your estate. This may include gifting strategies, setting up trusts, or taking advantage of any available tax credits. A proactive approach to tax planning can help preserve more of your wealth for your beneficiaries. Some of the key changes to be aware of in 2024 include that the gift tax exclusion amount has increased (last year it was $17,000 per individual and $34,000 per married couple). The new amount in 2024 is $18,000 per individual and $36,000 per married couple. Another update to consider: The Federal Estate and Gift Tax exemption has increased to $13.61 million per individual (double that, at $27.22 million for a married couple). In 2026, the amount is expected to drop down to $7 million per individual, so it’s important to work with your tax expert to strategize about how best to maximize your wealth via tax and estate planning, and the start of a new year is a great time to begin.

From IRS Rev Proc 2023-34

Healthcare directives and powers of attorney

It’s important to ensure that your healthcare directives and powers of attorney are up to date. These documents designate someone to make medical decisions on your behalf if you are unable to do so. Now is a great time to review your choices for healthcare agents and make sure they are still willing and able to fulfill this responsibility in accordance with your wishes. It’s vital to discuss your wishes regarding care with your chosen healthcare agent, providing them with clear guidance on your preferences. This step can alleviate the burden on your loved ones during difficult times and ensure that your healthcare decisions align with your values.

The new year presents an excellent opportunity to reassess and update your estate plan. By working through this simple estate planning checklist you can boost your peace of mind that everything is in order and help safeguard your legacy, protect your assets, and strategically provide for your loved ones. Take the time to consult with legal and financial professionals to ensure that your estate plan is comprehensive, up to date, and aligned with your current goals and circumstances. Planning for the future is not just for yourself; it's a gift to those you care about most.

If you have any questions about estate planning or how Whittier Trust’s wealth management services can help you navigate maximizing your legacy for future generations, we’re here to help. Start the conversation with an advisor today by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.