Typically, in portfolio asset allocation, the concept of diversification is deemed beneficial to avoid stock-specific risk. There have been many academic studies supporting this concept. Although diversification makes sense from a “risk-return” perspective, to have robust performance and beat benchmarks consistently, investors should find stocks that they are willing to hold in a sufficient portfolio weight that will consistently outperform benchmarks. With the S&P 500 averaging 8-10% annual returns, finding stocks that provide upside over the index is not an easy task.

Nevertheless, the one way we have found to accomplish this objective is to take positions in stocks that are disruptors - disrupting their industries or even creating new ones and fulfilling customer needs better than the competition. This means companies that are innovating in such a unique way over the longer term that the competition just cannot keep up. These companies rapidly gain market share from incumbents or even establish new end markets where there is little competition.

The modern-day example of such disruption is Nvidia. Most know the semiconductor industry was dominated by Intel for the majority of the late 20th century and into the 21st. Intel focused on central processing units (CPUs) that were the “brains” of personal computers, notebooks and servers. Intel relied upon Moore’s law, created by former Intel CEO Gordon Moore, which involved the doubling of computing power every two years. This worked well as the personal computer (PC) proliferated in global society and, later, as internet usage grew. Intel dominated its end markets and had few viable rivals.

But as Moore’s law reached its peak, Nvidia has taken the crown of the world’s largest semiconductor company by making its graphics unit processors (GPUs) more functional to manage the demands of artificial intelligence (AI). Nvidia’s semiconductors can work together in an array to create massive computing power and exceed the limits under Moore’s law. In addition, Nvidia management has indicated a doubling of computing power essentially annually with each generation of AI-based GPUs.

Such innovation has led to massive revenue growth with FYQ12025 (April) sales growth of over 262% and adjusted earnings per share growth of over 573%. Nvidia has been a clear disruptor in the semiconductor industry and remains at the forefront of AI innovation likely for many years in the future.

This is akin to Apple Inc.’s performance under former CEO Steve Jobs. On June 29th, 2007, Apple introduced the iPhone which clearly took the smartphone concept to a new level. Apple sales growth and stock price appreciation have been phenomenal from that date forward with an annualized revenue run rate just for iPhones of almost $200 billion (as of June 30, 2024) and the stock up 6000% (60x return) since the introduction.

So, what are some common denominators to successfully invest in disruptive companies?

We focus on the following:

- A Visionary CEO

- High Growth or Nascent Industry That Will Be Very Large

- Company’s Approach to Industry is Disruptive to Incumbents

- Advantage(s) Will Last for Long-Term – Creating a Moat

- Growing Free Cash Flow & Improving ROIC

1. Strong CEO Who is A Visionary

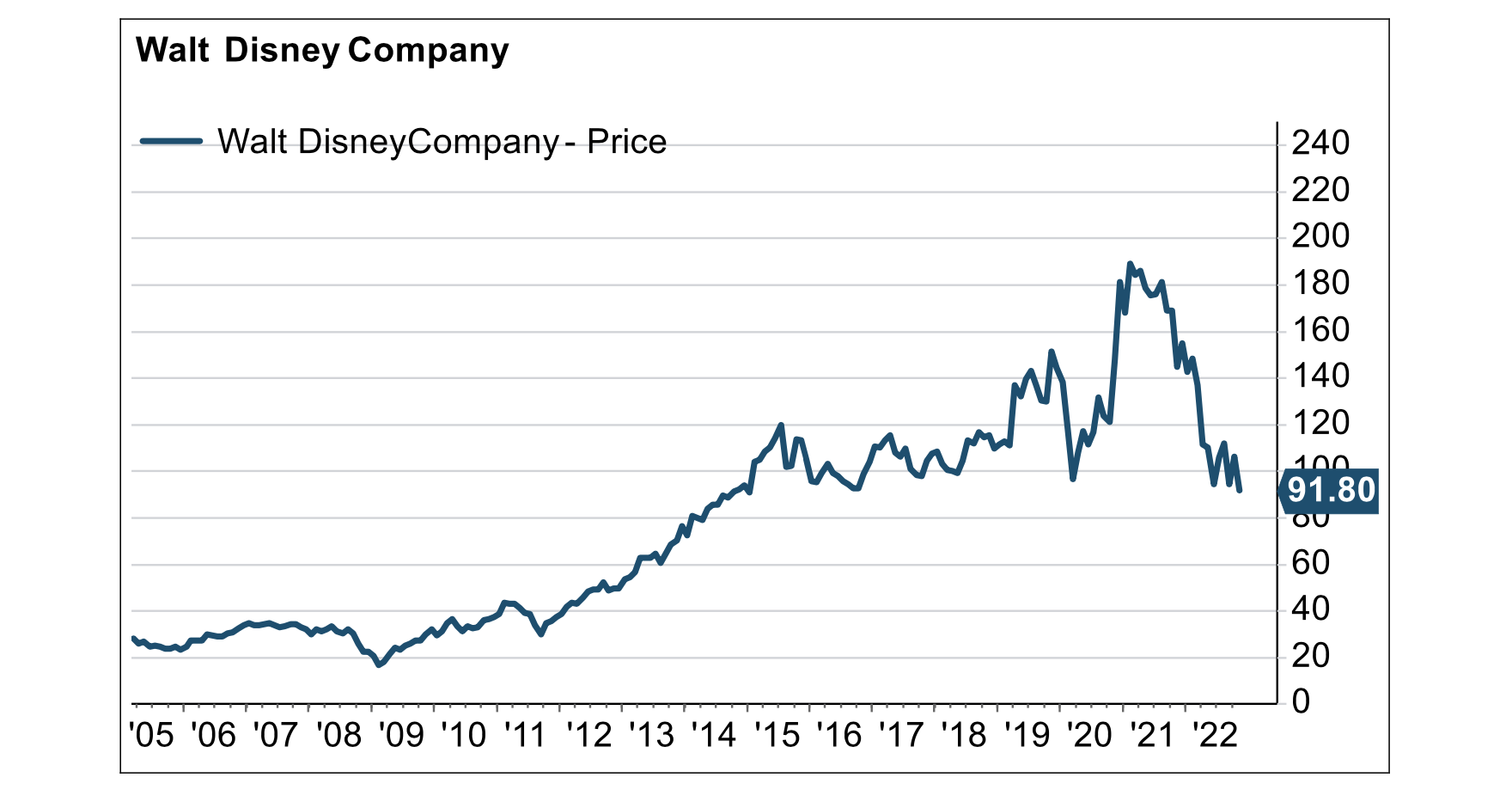

A visionary CEO is one of the most important things to look for when investing in the stock of any company, no matter the sector. There have been many instances where a visionary CEO was replaced by one who was not so prescient or insightful. These instances have typically led to the failure of the stock. We can point to many examples, with one of the most recent being Disney. CEO Bob Iger led Disney from March 2005 and retired at the end of 2021. Disney’s board chose Bob Chapek as Iger’s successor. The company went from a well-run entertainment conglomerate to one that had lost its competitive advantages in many end markets. Disney stock declined about 40% in less than a year under Chapek. Luckily, Iger returned in November 2022 with Chapek’s inauspicious dismissal.

2. High Growth Industry

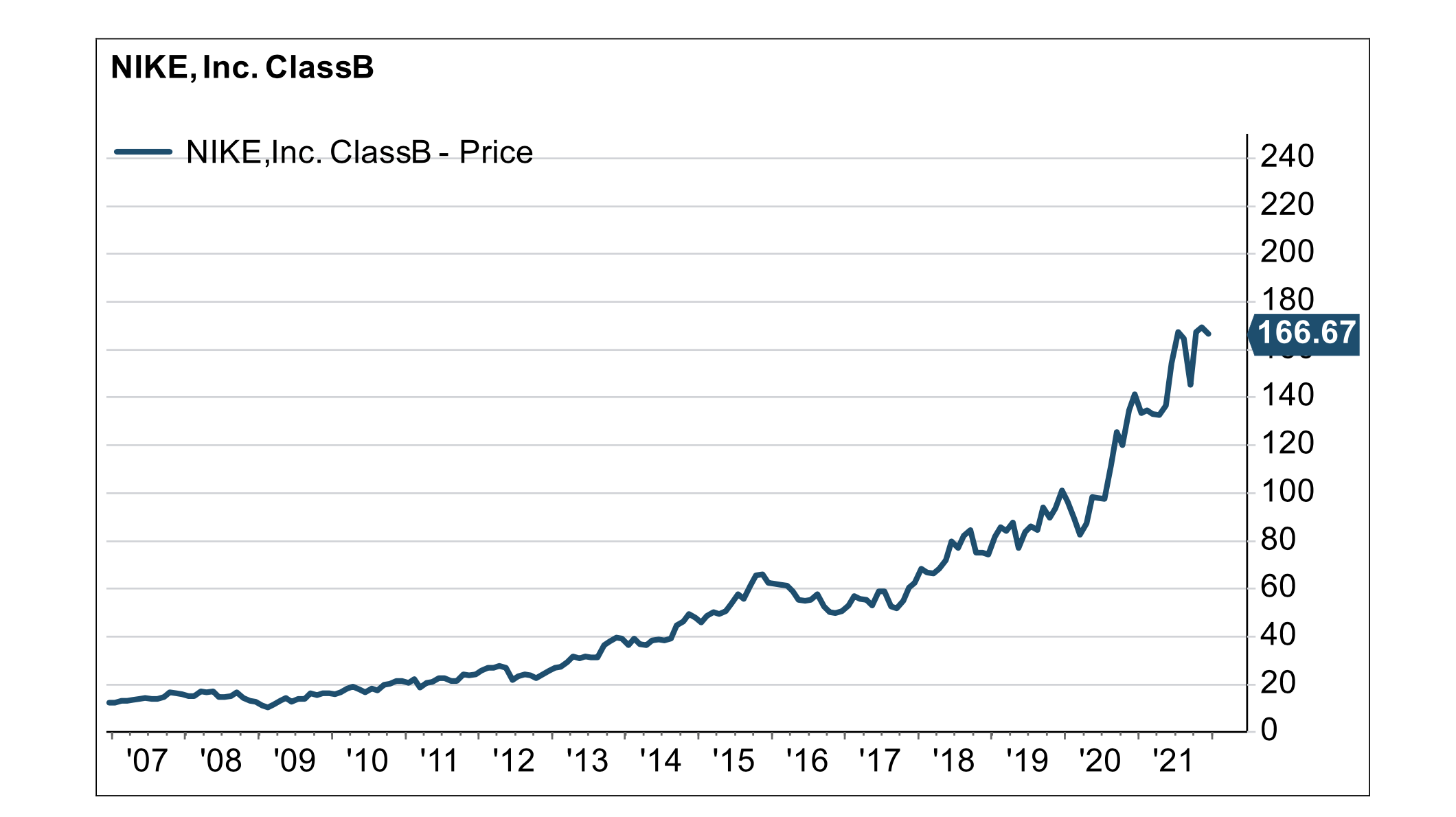

A strong company in a weak industry is usually a poor investment. Rather, the “secret sauce” is to own a “strong company in a strong industry”. This typically indicates a market share gainer with a large total addressable market (TAM). Nike’s rise to become the premier athletic shoe supplier was based on taking market share in an industry with an exceptionally large TAM. The same has been true for other disruptors like Nvidia, Meta, Eli Lilly and other stock success stories.

3. Disruption of Incumbents

On the introduction of the iPhone in June 2007, cellphone market leaders included Nokia, Motorola, Samsung, and LG. As discussed above, the iPhone was a giant leap forward in terms of both communication and computing. Apple’s growth under both CEO Steve Jobs and Tim Cook has been astounding, allowing Apple stock to surpass $3 Trillion in market capitalization. The first iPhone disrupted the cellphone market and created the world’s largest company by market capitalization. An investment of $100,000 at the introduction would be worth almost $5,800,000 today! There are many other examples of such industry disruption from Netflix for consumer entertainment to Chipotle for burritos.

4. Advantage(s) Will Last for Long-Term – A Moat

Any investment that does not offer a long-term advantage is arguably a trade. Trades are attractive to many investors but will not typically provide outsized gains, especially after short-term capital gains taxes are paid. Companies that are disrupting need a large “moat” to make sure their competitive advantages remain intact over the long term to generate outsized stock returns. This can be through patents and licensing (although enforcement internationally has been difficult), a superior customer interface or proprietary software (such as iOS for Apple or Cuda for Nvidia), or other means. Nvidia’s annual product cycles which entail massive improvements in performance and efficiency for AI systems (as seen with the transition from the Hopper generation of GPUs to Blackwell late in 2024 and with Rubin planned in 2025) are the latest method demonstrated to maintain a long-term technological lead over competitors.

5. Growing free cash flow & Improving ROIC

Ultimately, companies that are disrupting their industries should show extraordinary improvement in their financial metrics i.e. they need to generate outsized returns for investors. Some metrics to judge success are growth in free cash flows and return on invested capital (ROIC). These metrics allow an investor to monitor company progress in an impartial fashion. Improvement in both metrics over time should result from a successful industry disruption. Improvements in net margin also should be tracked.

Conclusion

Companies that are disrupting their industries have the possibility of adding outsized equity performance in a diversified equity portfolio. There are many historical examples including Apple, Starbucks, Nvidia, Nike, Netflix and others whose CEOs and/or founders out-innovated and tactically outperformed peers to either create massive new markets or garner massive shifts in existing market share. Undoubtedly, there will be new examples in the future. Finding such companies early in their growth cycles is a key to future investment success.

To learn more about Whittier Trust's market insights, investment services and portfolio philosophies, start a conversation with a Whittier Trust advisor today by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.