As the fall season and the upcoming new year usher in a sense of fresh beginnings, they provide an ideal opportunity to revisit an essential aspect of family wealth: preparing younger generations to manage and preserve it responsibly. Just as students gain knowledge for their futures, educating heirs about financial discipline and responsibility equips them to handle the complexities of wealth. This season is a perfect time to embrace a mindset of renewal and growth in family wealth education, establishing a legacy that will benefit future generations.

As the fall season and the upcoming new year usher in a sense of fresh beginnings, they provide an ideal opportunity to revisit an essential aspect of family wealth: preparing younger generations to manage and preserve it responsibly. Just as students gain knowledge for their futures, educating heirs about financial discipline and responsibility equips them to handle the complexities of wealth. This season is a perfect time to embrace a mindset of renewal and growth in family wealth education, establishing a legacy that will benefit future generations.

Wealth education is a crucial element of estate planning, empowering heirs to understand and build upon the foundation their families have established. Here are five strategies to create a culture of financial responsibility and stewardship within your family, and how Whittier Trust’s family office services can play an influential role in your journey.

1. Start Early

Integrating financial education at an early age is paramount to personal development. Foundational skills like budgeting, saving, and investing can be tailored to fit each stage of development, ensuring that wealth management becomes second nature. These early lessons should progress from simple financial activities, such as managing allowances or setting savings goals, to more complex discussions and experiences that develop a lifelong understanding of prudent wealth stewardship. Fostering these responsible habits will set your children up for success, supporting their futures in many ways.

2. Create a Family Legacy

True wealth education extends beyond numbers; it instills a deep-rooted understanding of hard work, family values, responsibility, and philanthropy. Children should be taught that wealth extends beyond financial capital—it represents the power to create, impact, and foster societal change. Family discussions centered around shared goals, charitable initiatives, and community contributions not only reinforce these values but also inspire a sense of purpose that transcends material wealth.

True wealth education extends beyond numbers; it instills a deep-rooted understanding of hard work, family values, responsibility, and philanthropy. Children should be taught that wealth extends beyond financial capital—it represents the power to create, impact, and foster societal change. Family discussions centered around shared goals, charitable initiatives, and community contributions not only reinforce these values but also inspire a sense of purpose that transcends material wealth.

3. Involve Advisors

Navigating the multifaceted nature of wealth management requires expertise, and a family office can play a vital role in supporting families through this journey. Engaging trusted advisors provides heirs with guidance that goes beyond family conversations, introducing them to the nuances of wealth management from a professional standpoint. At Whittier Trust, our team of advisors works alongside families to guide them in creating structured wealth education, ensuring heirs receive advice that reinforces family values and clarifies their financial responsibilities.

4. Foster Open Communication

Effective wealth stewardship is built on a foundation of open communication. Transparent discussions about the complexities of managing significant assets help develop a clear understanding of roles and responsibilities within the family structure. By encouraging questions and facilitating conversations about wealth, families create an environment where heirs feel empowered to participate actively and responsibly in managing the family estate. Such dialogue mitigates potential future conflicts and reinforces a unified family approach to wealth.

Effective wealth stewardship is built on a foundation of open communication. Transparent discussions about the complexities of managing significant assets help develop a clear understanding of roles and responsibilities within the family structure. By encouraging questions and facilitating conversations about wealth, families create an environment where heirs feel empowered to participate actively and responsibly in managing the family estate. Such dialogue mitigates potential future conflicts and reinforces a unified family approach to wealth.

5. Embrace Continuous Learning

Financial education should be an ongoing process, with each generation adapting to new financial landscapes and personal milestones. Incorporating continuous learning into family life—through discussions, advisor-facilitated workshops, or shared learning activities—ensures that heirs remain well-prepared to manage their assets as circumstances evolve. This commitment to lifelong learning fosters resilience and a proactive mindset, hallmarks of responsible and adaptive wealth management.

As you look to the future, consider how investing in wealth education can fortify your family’s legacy. By instilling these principles, families create a framework for future generations to navigate their financial responsibilities with acumen and respect for the values that define their family. By embracing these strategies, supported by Whittier Trust’s comprehensive expertise, families can establish a tradition of disciplined wealth stewardship that secures their prosperity and purpose for years to come.

To learn more about wealth education and the stewardship a multi-family office can offer future generations, start a conversation with a Whittier Trust advisor today by visiting our contact page.

From Investments to Family Office to Trustee Services and more, we are your single-source solution.

There are many reasons people place money in trust for their heirs.

There are many reasons people place money in trust for their heirs.  A similar business plan analysis should be undertaken when the beneficiary wants to buy an existing business or invest capital in a friend’s business. Most corporate trustees will be leery of the latter and often can play the role of “bad cop,” allowing the beneficiary to keep the friendship intact. In such cases, we are happy to let the friend know that the proposed investment is not aligned with the trust’s overall investment philosophy. This has saved more than one beneficiary from making an investment in a pal’s bar or movie.

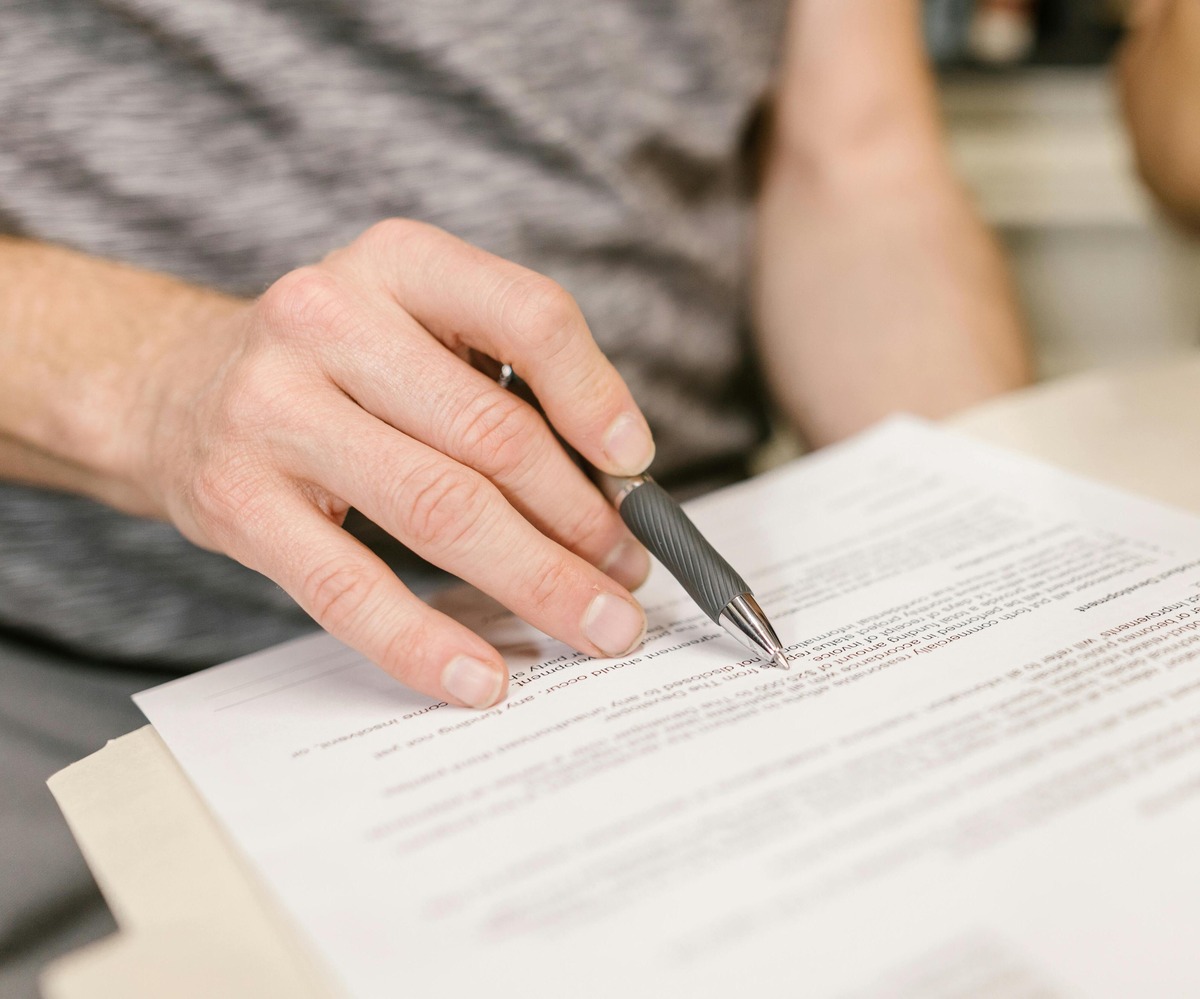

A similar business plan analysis should be undertaken when the beneficiary wants to buy an existing business or invest capital in a friend’s business. Most corporate trustees will be leery of the latter and often can play the role of “bad cop,” allowing the beneficiary to keep the friendship intact. In such cases, we are happy to let the friend know that the proposed investment is not aligned with the trust’s overall investment philosophy. This has saved more than one beneficiary from making an investment in a pal’s bar or movie. When looking for professional trustees, it is important to ask them about their practices and procedures when it comes to entertaining a beneficiary’s request for distributions. Some corporate trustees are relatively inflexible and only review requests monthly by committee. At Whittier Trust, we look at requests on a case-by-case basis as they are made since time is of the essence in certain situations. Also, ask if the main objective of the trustee is strict preservation of the trust for future generations or if they are willing to accept a letter of wishes or trust language that favors the current beneficiary. Any good trustee will welcome these conversations in advance of being named in the trust.

When looking for professional trustees, it is important to ask them about their practices and procedures when it comes to entertaining a beneficiary’s request for distributions. Some corporate trustees are relatively inflexible and only review requests monthly by committee. At Whittier Trust, we look at requests on a case-by-case basis as they are made since time is of the essence in certain situations. Also, ask if the main objective of the trustee is strict preservation of the trust for future generations or if they are willing to accept a letter of wishes or trust language that favors the current beneficiary. Any good trustee will welcome these conversations in advance of being named in the trust.

Whittier Trust, the oldest multi-family office headquartered on the West Coast, is pleased to announce the promotion of Brittany Renna, CFP®, APMA®, CTFA®, to the role of Vice President, Client Advisor, with the firm’s Newport Beach office.

Whittier Trust, the oldest multi-family office headquartered on the West Coast, is pleased to announce the promotion of Brittany Renna, CFP®, APMA®, CTFA®, to the role of Vice President, Client Advisor, with the firm’s Newport Beach office.